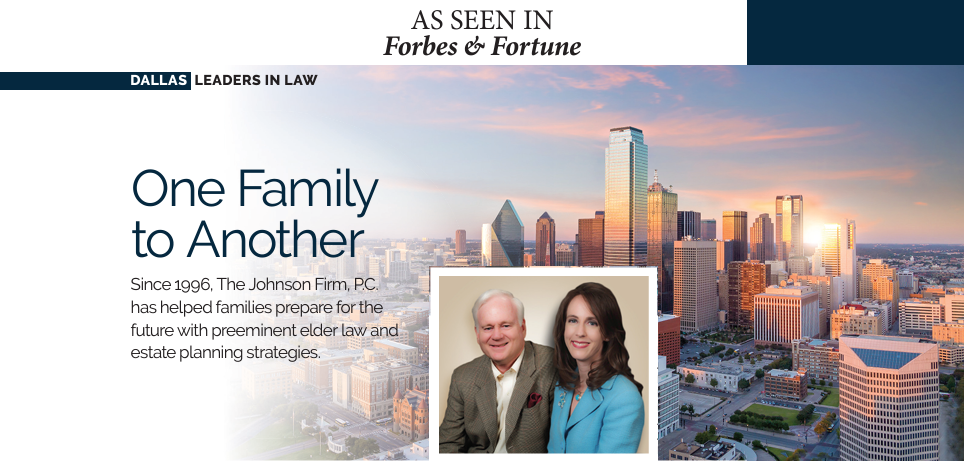

Submitted by The Johnson Firm on

There are many people who use trusts, not just the wealthy. In addition to serving many purposes, they address specific problems that are less concerned with wealth, and put the focus more on family dynamics.

- Do you want to keep your affairs private and stay out of probate court?

- Do you have a blended family?

- Do you want to leave money to your favorite charities?

- Do you own a small business and worry about liability?

- Do you have a child with special needs?

- Do you have an elderly parent who might need government benefits?

A well-designed trust holds your most significant assets, protects them, and eventually transfers them to your loved ones. You create the trust and fund it, acting as the trustee during your lifetime or choosing a trustee to manage and administer your funds before and after death. Trustees must provide beneficiaries with regular accountings of investment activity until you pass and your estate is settled. Choosing the right one is critical.

Selecting a Trustee

Trustees assume a fiduciary role and must carry out the terms of the trust in the best interest of your beneficiaries. They need to have some experience with estate administration and finances or hire someone to advise them. An inexperienced trustee may become overworked and overwhelmed. The wrong trustee can be intentionally uncooperative, abusive, or dishonest, leading to litigation.

If a trustee is not living up to their duties, beneficiaries can request a copy of the trust documents and records of estate transactions. Beneficiaries have the right to know where trust funds have been placed, how much income the funds have earned, and how much the trustee has spent on expenses and commissions. If your trustee has not provided you with an accounting, ask politely in writing and give them a reasonable timeframe to comply. Having an estate planning attorney send a letter may do the job. There may be a simple matter of miscommunication between the trustee and heirs. Your attorney can identify the problem and work things out amicably. If not, they may advise you to go to court.

Trust Litigation in Probate Court

Some problems are more difficult to resolve and require litigation with an estate planning attorney familiar with current trust administration and litigation laws in your state. They can determine if the trustee has mishandled the estate or breached their duties. Contact an attorney quickly because there are time limits and requirements when filing a case. You may be penalized for not acting promptly.

A trustee is responsible for communicating honestly and openly with beneficiaries, gathering and investing property of the estate, and accounting for property that passes through the trust. If your trustee has invested funds recklessly, lost money, or won’t communicate with you, those are civil disputes resolved in probate court. The probate judge can force uncooperative trustees to act or, if necessary, may remove the trustee altogether if they are unfit or the situation warrants it.

Avoiding Complications in the First Place

Our experienced estate planning attorneys can design a trust that clearly states the terms the trustee must follow. We will also advise you when selecting your trustee, ensuring you have considered the best options. Our attorneys can also serve as skilled trustees who already understand what is required in a complex fiduciary role.

If you’re a trustee or beneficiary and find yourself in a dispute, our estate planning attorneys specializing in trust administration and litigation would be happy to discuss your rights and provide solutions. We gather the required information, explain how your state laws work, and support you through negotiation and court processes when necessary. If you have questions or would like to discuss your legal needs please contact us at (520) 563-2020. We look forward to the opportunity to work with you.