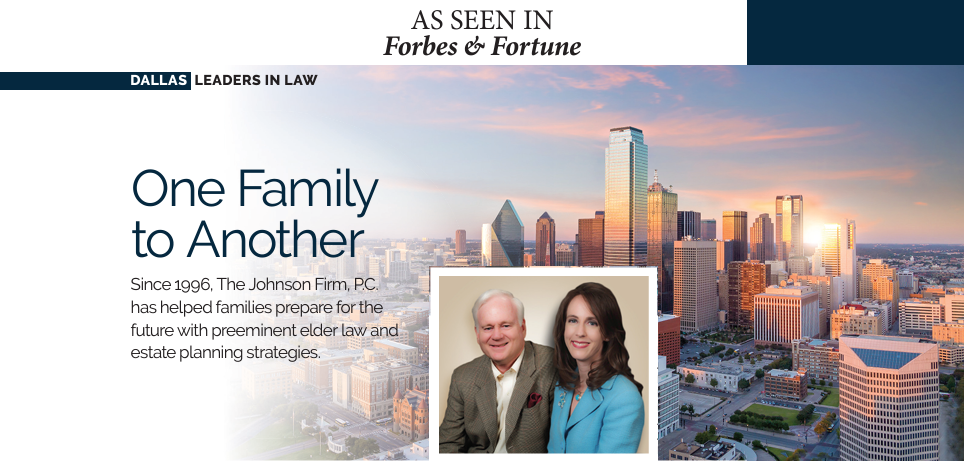

There are two types of estate planning and elder law: preplanning and crisis planning. The attorneys at The Johnson Firm, P.C. are here to guide you and your family in planning for the future and to guide you in a crisis situation so you can make informed decisions.

At The Johnson Firm, P.C. in Richardson, Texas, we know that many people have questions about estate planning and elder law. While we cannot answer all of them on our website, we hope the following answers to some frequently asked questions help you feel more informed. If you have more questions, we would be happy to discuss them with you in an initial consultation.

What happens if you die without a will?

In short, if you die without a will, the state of Texas determines who will inherit your assets. In most cases, this means your assets will be bequeathed to your next of kin, which may be your spouse or your children. If you do not have immediate family members still living, your assets will go to someone else. If you are remarried and have children from a prior marriage, they — not your spouse — may inherit your assets.

Having a will ensures that you decide who gets your assets. A will allows you to go into much greater detail about the distribution of your property than the state will even consider.

What is the difference between a revocable and irrevocable trust?

The simple answer to this question is that a revocable trust can be changed during your lifetime and an irrevocable trust usually cannot be changed. There are good reasons for choosing one over the other, and our attorneys can help you determine which may be best for you.

Do I really need an estate plan?

No one needs an estate plan. However, if you care about what happens to your assets and whether your family members who outlive you are protected, you need an estate plan. Even a simple will and testament can help ensure that your wishes are carried out.

What is an advance directive?

Also known as a health care directive or health care proxy, an advance directive allows you to provide directions about how you would like your end-of-life medical care to be handled. Do you want life-saving measures to be taken, even if your chances of survival are not strong? How do you feel about life support? Who do you want to be in charge of making medical decisions for you if you cannot? An advance directive allows you to provide answers to these questions and others.

Can my parent still qualify for Medicaid if they are already in a nursing home?

Yes. The sooner you contact us about the need for Medicaid, the sooner we can help you determine how to help your elderly loved one qualify for it.

How early should I start planning for Medicaid?

Medicaid has a five-year look-back period. This means that any gifts or asset transfers you make within five years of applying for Medicaid are assumed to have been done in an effort to qualify for Medicaid. To avoid any possible penalties related to the five-year look-back, starting your planning more than five years before you think you will need coverage is wise.

We understand it can be difficult to know when you or a loved one will need Medicaid. Our attorneys can help you determine the right time for you to start planning.

Do I really need an estate planning attorney?

While you can certainly create an estate plan on your own, it is wise to work with an attorney instead. At the very minimum, it is beneficial to have an attorney review your estate planning documents. However, attorneys can provide important benefits beyond that.

Your attorney can help you create an effective estate plan that is based on your unique assets and your specific goals. An online, fill-in-the-blank estate planning document cannot do that for you. Additionally, your attorney can ensure that your estate planning documents comply with Texas laws. If your documents are not compliant, they may not be upheld in probate — and the estate plan you created may be obsolete.

Have More Questions? Ask Us In Your First Consultation.

We can answer more of your questions in your first consultation. To schedule a time to visit our office, please call us at (972) 299-3488 or reach out to us online.