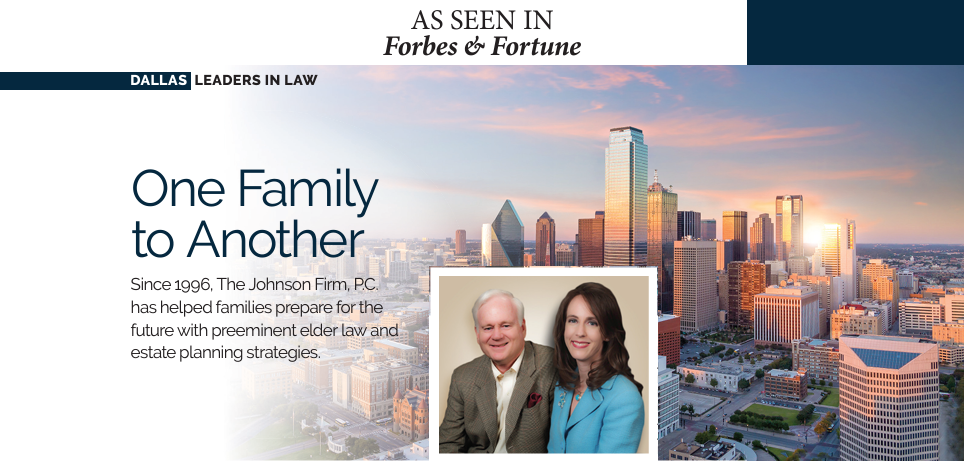

Submitted by The Johnson Firm on

Before seeking medical care, imagine if you were ill and had to decide if you could afford it. Unfortunately, for many Americans, seeking medical care hinges on affordability rather than medical necessity.

About half of US adults have gone without or delayed medical care in the last year due to a lack of affordability. Even with insurance benefits, many are still unable to afford the high cost. Approximately one-third of insured US adults are worried about being able to afford their monthly premiums. Additionally, 44% worry that they can't afford their deductible. Healthcare costs are rising globally, but the US accounts for more than 40% of total global spending.

The Cost of Avoiding Treatment

Delaying or avoiding annual checkups or treatment for a seemingly minor illness may seem like an easy way to cut expenses. However, it may result in significant physical and financial costs later. For example, minor problems can become chronic illnesses as we age and eventually lead to the need for long-term care. This financial burden can carry over to other family members or result in losing a home or a lifetime of savings.

Complications from minor illnesses can easily be avoided with basic treatment. Otherwise, infections can worsen, potentially leading to hospitalization or other serious conditions.

Annual checkups and preventative care are the first line of defense against disease and provide early detection for better health-related outcomes. Routine cardiovascular exams and various cancer screenings save thousands of lives every year.

Preparing for Health Care Costs with Employee Savings Plans

It's hard to predict the cost of doctor's visits if you're uninsured or have a high-deductible health insurance plan without copays. Healthcare bills are usually higher than anticipated, which creates financial strain and debt. Many people turn to family and friends to borrow money or deplete retirement accounts or home equity to pay medical bills. Unexpected accidents or illnesses can cause lasting financial damage.

One way to prevent medical debt is by contributing to a health savings account HAS) or flexible spending account (FSA). A payroll deduction puts tax-free funds directly into your account to use for out-of-pocket medical expenses, including vision and dental needs. HSAs have annual contribution limits and are usually only available to those with high-deductible health insurance plans. FSAs may have a slightly lower annual contribution limit and a requirement to use the funds within that calendar year.

Creating Your Own Savings Plan

You can create your own savings account to use for medical and financial emergencies. Research different financial institutions to find the best interest rate. Then stretch your savings by comparing treatment prices on your insurance provider’s website or checking with customer service. You can also look at third-party sites like Clear Health Costs, FAIR Health, and Healthcare Bluebook for average costs.

Also, let your doctor know if you are having trouble affording your medications. They won’t offer low-cost options unless you tell them it’s a concern.

Many Americans avoid treatment regardless of income level and access to health insurance. Our elder law and estate planning attorneys help families plan ahead to avoid the financial devastation that can result from high healthcare costs in medical emergencies and the need for long-term care as they age. If you would like to learn more, please contact us at (520) 563-2020. We look forward to the opportunity to work with you.