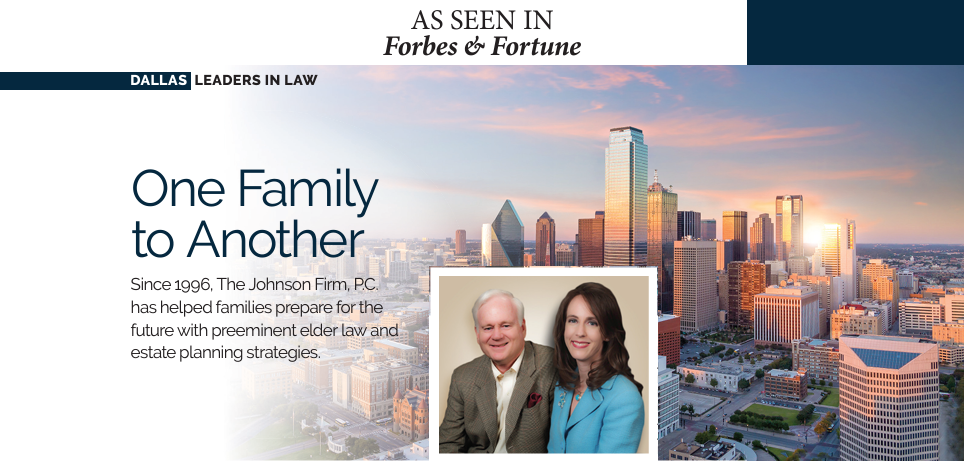

Submitted by The Johnson Firm on

The award you receive from a personal injury lawsuit can be received in a lump sum or as a structured settlement. You may opt for a substantial initial amount with lesser succeeding payments to provide for lost income. These payments don't count for income tax purposes, affect government benefits eligibility, or stop a designated heir from receiving the remaining payments tax-free upon your death. A structured settlement is ideally suited as partial or full funding for a first-party special needs trust with a disabled beneficiary. It also lowers administration costs since only trust assets will be subject to fees.

Protecting Your Settlement Funds

Structured settlements and trusts combine to protect funds from financial predators, creditors, or a trustee with poor money management skills. Adequately funding a special needs trust with a structured settlement is crucial so that the individual with disabilities will have a steady stream of income along with public benefits. A structured settlement typically establishes this reliable income using an annuity purchase from an insurance company. In general, structured settlements offer significant flexibility in terms of duration and payment amounts. A special needs lawyer can help you understand your options before deciding how to settle a personal injury lawsuit.

Initial Funds to Operate the Trust

The special needs trust must receive sufficient seed money, ensuring the trustee can make the initial payments necessary for the beneficiary and provide corporate fiduciary options. This way, the special needs trust beneficiary has immediate funding available without waiting for an annuity’s longer-term payout. Furthermore, who you can choose as a professional trustee of the special needs trust is affected by the initial funding amount and size of the trust. The annuity’s payee becomes the special needs trust rather than the beneficiary since monies directly paid to the disabled individual affect their eligibility for government benefits.

Medicaid’s Recovery Program

The Medicaid program requires all first-person special needs trusts with structured settlements to have a lien satisfied upon the beneficiary’s death. The special needs trust will still receive the structured settlement payments; however, the Medicaid lien will be satisfied first, and the rest will go to any remaining beneficiaries. A commutation clause must be part of the annuity provisions in case the disabled beneficiary dies prematurely. The clause states that all remaining assets of the annuity would be paid into the first-party special needs trust within a limited period, allowing for timely payment of death taxes and trust closure. The commutation clause prevents the trust from becoming insolvent before death.

Local Laws Impacting the Trust

If you're considering the purchase of a structured settlement such as an annuity to fund a special needs trust, find out about your county's jurisdiction and position regarding allocating the principal and income for structured settlements. The principal funds for a special needs trust for a disabled person or minor must be spent with court approval. Some counties consider almost all annuity payments to be income. In contrast, others deem a percentage as income and the remaining as principal. County jurisdiction affects the trustee's requirements to seek court approval for the ongoing needs of the beneficiary.

Professional Advice

To avoid problems integrating a structured settlement with a special needs trust, retain a special needs attorney familiar with county and state-specific regulations, as the timing and sequence of events are crucial. A special needs lawyer will advise personal injury attorneys on the proper structure and terms for the trust. Improperly drafted documents can trigger earlier reimbursements, making the beneficiary ineligible for government benefits. The special needs lawyer will also know not to name a family member as a beneficiary as it can result in the state making a fraudulent conveyance claim.

Special needs trusts funded by a structured settlement are more complex to manage than many other trust types. A special needs attorney can help educate the trustee concerning qualified disbursements to preserve eligibility for public benefits. With so much at stake for the individual with a disability, it makes sense to employ a professional trustee to keep proper records, manage assets, help with tax preparation, handle bills, and ensure trust distributions maintain the beneficiary’s eligibility. Before receiving a structured settlement in a personal injury case, consult with a special needs attorney.

We hope you found this article helpful. Please contact our office at (520) 563-2020 to schedule a consultation to discuss your legal matters.