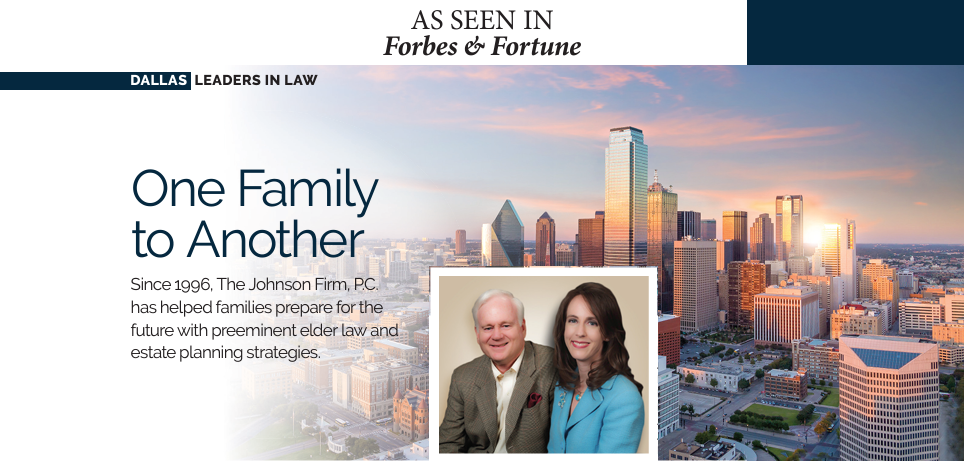

Submitted by The Johnson Firm on

There is no way to predict what the future holds for any of us. Health and wealth preservation require planning. Whatever happens, estate planning attorneys can help you legally reduce your estate and income taxes to protect your assets and family legacy.

Creating a strategic estate plan is a comprehensive process, and you need an attorney who understands you, your business interests, and your family relationships. Don’t overlook the importance of family dynamics when creating an effective estate tax strategy. Your children can receive a larger inheritance when passing assets before death. Properly restructuring assets in advance can eliminate tax consequences to your overall estate.

The Importance of Tax Planning for Your Estate Plan

It’s crucial to create a tax plan and estate plan together as they heavily influence each other. If you have a separate tax advisor, they need to coordinate with your estate planning attorney to avoid duplication of work effort and create a seamless strategy.

Tax legislation is always changing and may impact your trusts. Proposals currently target higher-income taxpayers with an additional five percent tax on income over ten million dollars, with an additional three percent tax on those above twenty-five million dollars. This affects how many people structure their trusts like a credit shelter or create a family trust on the death of the first spouse.

The Value of a Trust in Your Estate Plan

Grantor trusts remain taxable to the settlor; however, non-grantor trusts (complex trusts) generally pay their own taxes and require close monitoring as regulations change. A non-grantor trust pays taxes on all earned income; however, it receives a deduction for beneficiaries’ income (distributed net income). Your estate planning attorney can review your trust and make the necessary adjustments for recent legal changes.

Creating more than one scenario for your estate to remain flexible to tax law changes is key to implementing changes quickly. Bear in mind some of these proposals cite the date of enactment as the effective date for the rule; other proposals may be retroactive to the date they were brought to legislators. Options of action can include several provisions in your trust documents permitting you to change or modify the trusts. Some of these provisions can include:

- Decanting provisions allow the trustee to decant into a new trust. However, some proposals may restrict decanting, replacing any state law rights permitting decanting.

- Disclaimer provisions that provide the right to designate a person as the primary beneficiary and disclaim all assets transferred into the trust; reverting assets to the donor/settlor.

- Permitting the trustee to disclaim. However, it could violate the trustee’s fiduciary obligation to all beneficiaries.

- Allowing a named person to turn off the grantor trust status assures the ability to modify the trust’s income tax status if it proves advantageous.

- Naming a trust protector with authorization to change trustees, governing law, situs, administrative provisions, etc.

- Giving power to the trustee to divide the trusts to take different actions if it becomes useful.

- Naming a broad class of beneficiaries, including charities, gives the trustee flexibility to include capital gains income and provide broad discretion or distribution of income and perhaps principal out of the trust.

There are other estate planning and tax planning tactics to employ, but it’s evident that the complex law governing trusts and the potential for changes need to be in the hands of a competent estate planning attorney.

You’ve worked hard throughout your lifetime to build generational wealth for your family. Proper estate planning is the way to ensure your assets won’t see a dramatic reduction due to taxes. The time to plan and implement your legal strategies is now. Proactively getting out in front of the changes is in your best interest.

We hope you found this article helpful. If you have questions or would like to discuss your legal needs please contact us at (520) 563-2020. We look forward to the opportunity to work with you.