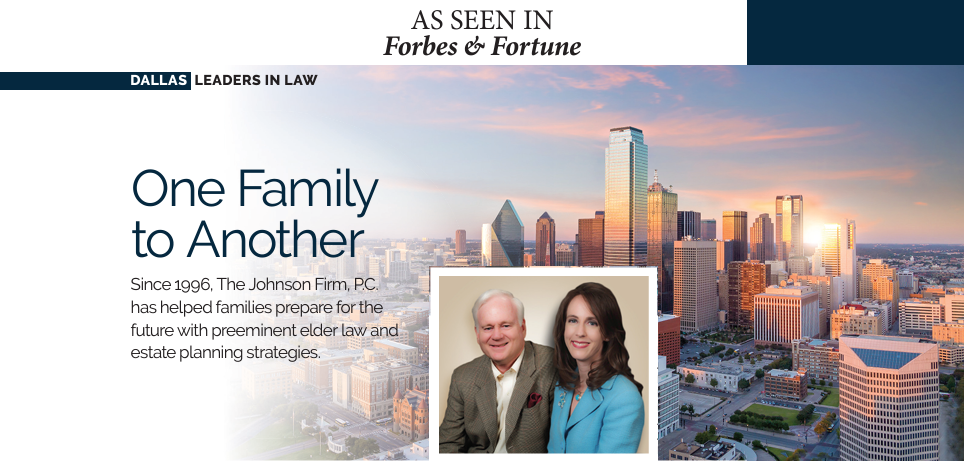

Submitted by The Johnson Firm on

As a result of inheritance in a blended family, families may feel hurt and inequitably distributed, leading to lengthy legal battles that can be both costly and destructive to the family.

While you cannot legislate from the grave, you can carefully prepare your estate plan, distinctly accounting for biological and stepchildren to minimize the potential for conflicts. Paying close attention to your estate plan today can ensure your assets will seamlessly pass to heirs as you wish.

Understanding Beneficiary Designations for Blended Families

Many people may misunderstand beneficiary designations on insurance policies and retirement accounts because it seems so straightforward. And in truth, it is. It does not matter what your trust or your will says; the assets of these beneficiary accounts will go to the primary beneficiary. Beneficiary designations trump everything else. Even secondary (contingent) beneficiaries will be at the behest of the primary beneficiary, who may do whatever they choose with the assets. Be sure all named beneficiaries reflect your current wishes. Often a former spouse can be accidentally left as a primary beneficiary to an account. Once the asset is in the beneficiary’s name, neither your will nor trust can control it. Some financial institutions will permit the naming of multiple primary beneficiaries with designated percentages of asset distribution. However, the financial institution’s forms holding these assets must reflect the precise language required for multiple primary beneficiaries.

Understanding Trusts, Directives, and Powers of Attorney for Blended Families

Regarding trusts, whether revocable, irrevocable, or joint pour-over, remarried couples will often employ a trust to handle estate asset distribution for tax advantages and because you can name multiple trustees. Your family situation and amount of assets will determine the best trust type for your estate. Remember that a trust does not preclude the necessity of a will. A will ensures assets not titled in the trust’s name transfer according to the decedent’s wishes. Also, remember those assets named in a will pass through probate. It is not uncommon to have separate trusts for a real property like a home or acreage and a separate trust for investment accounts that do not have named beneficiary options.

Even advanced medical directives and the designation of a medical power of attorney can create problems in a blended family. A new spouse may want to be the medical power of attorney and make healthcare decisions. Biological adult children often struggle with a change such as this, particularly if they harbor a suspicion the motive for marriage by the new spouse is to attain wealth. Be sure to have an open dialogue about this issue to allay any fears of your adult children.

Pew Research Center cites a study that shows four-in-ten new marriages involve remarriage, and the numbers continue to rise steadily. These days families often include children, stepchildren, former spouses, and in-laws from both remarried spouses. In twenty percent of remarriages, both had previously been married. These statistics make for some interesting family dynamics, and no two situations are the same. Most remarried couples prefer to ensure the surviving spouse will receive lifetime care if the other dies. Still, they want their children from their previous marriage to be the ultimate beneficiaries of the assets brought to the remarriage.

How Do Blended Families Prepare an Estate Plan?

Ultimately the mechanics of your estate plan will run more smoothly if decisions regarding assets are put to paper in a prenuptial agreement before getting remarried. While a prenup is not an estate plan, conversations about inheritance with your fiance, biological, and stepchildren “to be” can clear the air before walking down the aisle and make for a positive, new beginning.

If you are already remarried without a prenuptial agreement, private wealth consultant Dean Deutz with RBC Wealth Management suggests beginning your planning with a flow chart. Visualizing the ultimate path of a spouse’s assets, no matter who passes away first can clarify your asset distribution objectives and approach. Once a couple identifies the best path forward and the level of control they want the surviving spouse to exercise, it is just a matter of executing the plan with legal documents. If the remarried couple intends to keep assets separate, with each spouse passing inheritable assets to their children, maintaining that separation is crucial. Dean Deutz shares, “Once you start blending assets in accounts, then the other spouse has a claim.”

Be aware that stepchildren may contest a will if they have standing. Suppose the stepchild is a named beneficiary in a prior will. In that case, they will have the standing to contest a newer will generally citing undue influence, lack of capacity, fraud, mistake, or coercion. If the probate court throws out the contested will, the estate inheritance plan reverts to the next most recent will. Will contests often occur when a biological parent and stepparent make identical wills simultaneously. Upon one parent's passing, the surviving parent changes the estate plan for all children to inherit equally or provide preferential treatment to their biological heirs.

The best way to avoid potential contests to your will and estate plan in court is to get out in front of the problems before they occur. The goal is to protect everyone’s interest as the benefactor deems appropriate and fair. Planning and implementing the structure of your estate solution takes time and careful thought. Arrange to speak to your estate planning attorney about how best to handle your blended family and their inheritance.

We hope you found this article helpful. If you have questions or would like to discuss your legal needs please contact us at (520) 563-2020.