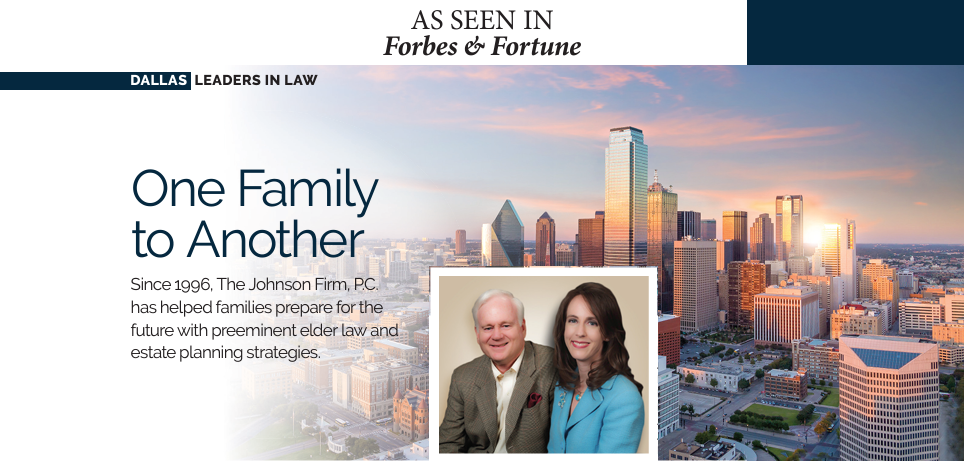

Submitted by The Johnson Firm on

A living will specify your wishes regarding life-sustaining medical treatment. It is often accompanied by a healthcare proxy or power of attorney, which allows someone to make treatment decisions for you if you are incapacitated and the living will does not have specific instructions for the situation at hand. “Living will” and “advance directive” is often used synonymously, but a living will legally only applies after a terminal diagnosis, whereas an advance directive is much more comprehensive and includes the health care proxy.

As of 2017, only around one in three American adults had an advance directive for end-of-life care prepared. Those who are older than 65 are more likely to have an advance directive prepared than those who are younger, as are those who have a chronic illness more likely than those who are not. People may be unwilling to prepare these documents because they fear that they won’t necessarily reflect their wishes at the time they become relevant; sometimes patients become more willing to undergo treatments they rejected when they were younger as they age and develop medical problems. However, the documents can be changed as long as they are witnessed and potentially notarized (depending on current law). And if you continue to communicate your values with your proxy, they can make decisions based on your most recent preferences.

So why is a living will important? It reduces ambiguity which can prevent family disputes during what is already a difficult time. It may seem like something that can be put off, but life is unpredictable; one never knows when these documents could become relevant. Furthermore, it needn’t be a hassle. A living will is a straightforward document, however, it’s important to work with legal counsel to make sure your beliefs are properly stated. Other healthcare documents should also be prepared at that time, like a healthcare power of attorney that designates a person to make healthcare decisions for you if you are unable. Once you have signed any documents make sure you keep them updated, especially if you change states, and be diligent in communicating with whomever you named to act on your behalf.

If you need a living will or health care power of attorney or already have one that you would like reviewed, please contact us at (520) 563-2020. We look forward to the opportunity to work with you